21 Million Bitcoin

Published: 2020-12-19 at block 662,061

Bitcoin Price: $23,300

Table of Contents

- 21 Million Bitcoin

- Why and How Is Bitcoin’s Supply Fixed?

- Why 21 Million Bitcoin?

- When Will The Bitcoin Supply Reach 21 Million?

- What Happens When Bitcoin Reaches 21 Million?

21 Million Bitcoin

Everyone has heard that Bitcoin’s supply is capped at 21 million bitcoins, but not as many people understand:

- Why and how it’s fixed

- Why it’s specifically fixed at 21 million

- When the supply cap is expected to be reached

- and what happens after it hits the supply cap

I answer these questions in this blog post by diving into topics like the predictable issuance schedule; purchasing power; the world’s M1 money supply; Bitcoin’s security budget; BIP 42, and more.

Why and How Is Bitcoin’s Supply Fixed?

Whether from his old forum posts or the message he encoded into the genesis block, many believe that Satoshi fixed the supply of Bitcoin in response to centrally-managed, inflationary monetary policies (like quantitative easing and fractional-reserve banking).

To “escape the arbitrary inflation risk of centrally managed currencies,” Bitcoin had to be designed as a network of rules, not rulers. So Satoshi created a bunch of rules before launching the network, which resulted in Bitcoin’s fixed supply:

One of Bitcoin’s rules is its predetermined inflation rate - ie. how many bitcoins will be created and at what rate. It says that initially, (1) Bitcoin will mint 50 new bitcoins every block (~10 minutes), and (2) every 210,000 blocks (~4 years), the number of bitcoins minted every block will halve (eg. from 50 to 25). This rule explains why Bitcoin’s supply is fixed and allows us to extrapolate the total number of bitcoins to ever be mined at approximately 21 million. If you’d like to learn more about this rule, you may want to look up terms like: the subsidy halving, issuance schedule, predictable inflation algorithm, disinflation, mining schedule, etc.

Another rule is that any change to Bitcoin’s rules can only be accepted if the majority of network participants (like miners, full node operators, businesses, developers, etc.) agree, adopt, and enforce the rule change. This “meta” rule helps the network enforce the 21 million fixed supply: if a central bank wanted to increase the 21 million supply cap or change Bitcoin’s monetary policy in any other way, they would only be able to do so with the majority of the network’s permission. On the other hand, if an actor tried to increase the supply limit without the majority consensus, peers in the Bitcoin network would simply reject that action as invalid because it doesn’t adhere to the rules.

Put simply, rule #1 is to adhere to the issuance schedule and rule #2 is to adhere to rule #1 (among other rules).

So in an attempt to create an alternative, disinflationary money, Satoshi created a bunch of rules that ultimately have set and enforced Bitcoin’s supply at ~21 million.

As such, those who oppose the popular expansionary monetary policies employed by central banks have begun flocking over to Bitcoin. Why? Because of Bitcoin’s predictable, disinflationary issuance schedule and strongly-enforced 21 million supply.

Such proponents believe that the purchasing power of their money should increase over time rather than decrease from inflation. As believers in free markets, they expect that a fixed supply matched with increasing demand will lead to a natural increase in price.

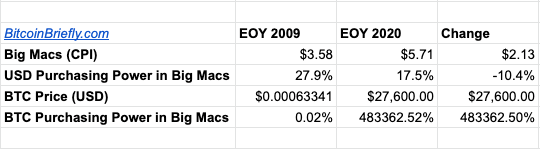

Using the Big Mac Index as a proxy for the Consumer Price Index (CPI), we can see the disparity in purchasing power over time between the two assets, highlighting why so many people find Bitcoin attractive.

Why 21 Million Bitcoin?

So Bitcoin’s supply is fixed because of its preset inflation rate and enforcement by the majority consensus. But why is it capped specifically at 21 million?

Perhaps Satoshi just picked a bunch of random numbers for the block time, satoshis per bitcoin, initial block subsidy, etc. and these factors coincidentally ended up limiting the supply of bitcoin to 21 million.

But there is strong reason to believe that the 21 million limit was the result of specific design decisions that sought to propel Bitcoin’s displacement of the world’s national currencies.

Rich Apodaca (Bitzuma) explains in a blog post that to replace the world’s national currencies, Bitcoin would need to adhere to certain restrictions. It is believed that these restrictions resulted in the specific number of satoshis per bitcoin, the 210,000 block halving issuance schedule, and ultimately the 21 million supply cap. These restrictions are listed below:

The number of satoshis must (1) fit within the IEEE floating point system (a computer science schema that keeps numbers precise instead of rounded, as long as the total number is under 2^53: 9 quadrillion) and (2) include a safety margin: a one-bit margin would result in the maximum threshold of 2^52 (4.5 quadrillion), and a two-bit margin would result in 2^51 (2.3 quadrillion).

Parity between the US Dollar and bitcoin (ie. 1 BTC = 1 USD) could be reached without spooking investors. In other words, if Bitcoin were a country, it would have one of the smallest M1s in the world if bitcoin achieved dollar parity.

Furthermore, parity between the US cent and satoshi could be reached if the Bitcoin market capitalization became roughly the same as the global M1 money supply. In other words, the number of satoshis must be roughly equal to the global M1 money supply as of 2009 when Bitcoin launched, which was about 2 quadrillion US cents at the time. This restriction helped establish the 100,000,000:1 satoshi to bitcoin ratio.

Also, the halving schedule should ensure that block subsidies could continue to be paid until Bitcoin has reached a critical mass of adoption, at which point transaction fees would become self-sustaining.

It seems that there were some assumptions made: there’d be 1,000 users by the end of 2009; the user base would double every year; and the maximum user base would be capped at the world population in 2009 (6.8 billion). So to hit 6.8 billion from 1,000, Bitcoin’s user base would need to double every year for 23 years. The number of halvings required to reduce the subsidy fund by 99% is 6. Dividing 24 (23 years + the 1st year) by 6 makes 4 years per halving.

So in the 7th block reward era (ie. after 6 halvings), 99% of bitcoins would be mined. And because Bitcoin makes it easier to count blocks instead of time, then each epoch would last 210,000 blocks, based on the difficulty target of producing one block every ten minutes. Starting with an initial block subsidy of 50 btc per block, this would result in the production and supply cap of 2,099,999,997,690,000 satoshis (nearly 2.1 quadrillion - a number that fits within the constraints listed above).

Finally, Ray Dillinger (aka Cryddit, the first person who commented on Satoshi’s white paper) provides anecdotal evidence that supports the rationale behind the 21M limit.

In summary, the IEEE standard, parity milestones, halving schedule, and anecdotes provide evidence behind the specific number of 21 million.

When Will The Bitcoin Supply Reach 21 Million?

Based on Bitcoin’s difficulty adjustment algorithm and the 210,000 block (4 year) halving schedule, the Bitcoin supply is expected to be fully mined (~21 million bitcoins; more specifically 2,099,999,997,690,000 satoshis) in the year 2140.

Though 120 years may seem like a long time, other significant milestones will come much sooner:

What Happens When Bitcoin Reaches 21 Million?

Every block provides miners with two streams of revenue: the block subsidy and transaction fees. When all 21 million bitcoin have been mined, mining revenue will only consist of transaction fees. Thus, transaction fees must provide enough financial incentive for miners to continue processing transactions, adding blocks to the blockchain, and securing the network.

Critics claim that transaction fees won’t be enough to sustain Bitcoin and its security budget, and those concerns loom larger as we get closer to the year 2035, when 99% of bitcoins are expected to be mined. Yet, despite every halving, the network has grown more secure and Bitcoin’s sustainability through transaction fees looks more and more promising:

As the subsidy continues to halve; as the price of bitcoin increases; as the Bitcoin user base grows; as the number of transactions increases; as demand for block space grows; as more miners compete to earn bitcoins; as the hashrate increases; etc.... We can expect Bitcoin transaction fees to not only represent a greater percentage of the total block reward but also continue to incentivize miners to secure the network.

For further reading on this topic, I’d recommend Dan Held’s blog post on Bitcoin’s Security Budget.

Fun Fact

When Bitcoin went live, Satoshi unintentionally introduced a bug that would re-issue a new supply of 21 million bitcoins every 64 block halvings. The effect was similar to discovering a new gold mine every ~250 years. Though parameters like the inflation schedule were expected to cap the supply to 21 million, the bug would over-shift these values causing the supply to actually inflate forever.

It wasn’t until 2014 that ditto-b noticed the bug. The Core developers used the opportunity to package up an elaborate April Fool’s joke and fix in BIP 42. As prolific core developer Pieter Wuille explains, “it claims (jokingly) that Bitcoin was designed to look like it had a 21 million limit, but through underhanded programming didn't actually do that.”

BIP 42 is a backwards-compatible fix, encouraging miners to take a lower subsidy than the max after the 64th block reward halving. If instead, a miner chooses to consume 100% of the max subsidy, they will be forked from the network.

Interested in learning more about Bitcoin’s history of bugs? Check out the blog post Hacking Bitcoin: A History of Bitcoin Hacks.

Hope you found this blog post insightful - if you did, make sure to subscribe to the newsletter to stay up to date on the latest posts!

What else would you like to learn more about? Let me know on Telegram!